The Arithmetic Behind Drawdowns and Recoveries

Most advisors and investors have at some point stumbled upon Warren Buffet’s “rules of investing.” The first two rules are especially memorable:

Investing Rule No. 1: Never lose money.

Rule No. 2: Never forget rule No. 1.

-Warren Buffet

Seems like a simple idea, but tough to implement unless you’re buying lower-risk, low-return securities. The main takeaway is that in order to compound capital effectively, it requires not destroying capital in the first place.

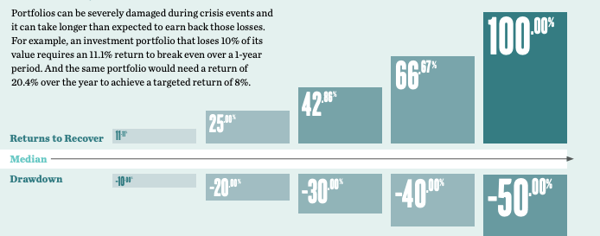

But there’s another aspect to this lesson that advisors can pass along to their clients: the dramatic effects of large drawdowns and why downside risk mitigation is so important. Many less-financially sophisticated investors don’t fully understand the arithmetic around losses and recovery. For example, if you asked all your clients if they thought a 20% return would result in a full recovery after a 20% drawdown, a few would probably agree. But in reality, a 20% drawdown requires a 25% recovery to get back to the pre-drawdown level.

Image source: https://www.ssga.com/investment-topics/equity/2017/Equity-Market-Risk_Guide.pdf

Of course, this concept is magnified with larger losses, as the graph above illustrates. A 50% haircut would require a whopping 100% return to fully recover. How long would that take to achieve? If a long-term 8% stock market rate of return in assumed, a 100% return would take approximately nine years to accomplish!

The phrase “downside protection” gets used all the time in our industry. But it’s a worthwhile exercise to make sure the managers you trust with your “risk assets” (equity, high yield credit, etc.) have a disciplined approach to risk management that has fared well in past recessions. With the spread between 3-month and 10-year Treasury yields having recently inverted, which many investors believe indicates lower future economic growth and a potential recession, paying attention to your manager’s risk management processes is as important as ever.