Why Equal-Weighted Positions Can Help Minimize Drawdowns

The majority of actively-managed equity funds that exist today utilize conviction-weighted position sizes. The reasoning behind this approach is that the portfolio managers managing these funds believe they have an edge by overweighting their favorite stocks relative to the funds’ benchmarks. It’s common for concentrated portfolios (say, fewer than 40 holdings) to have around 25%-30% in their top-five holdings.

The majority of actively-managed equity funds that exist today utilize conviction-weighted position sizes. The reasoning behind this approach is that the portfolio managers managing these funds believe they have an edge by overweighting their favorite stocks relative to the funds’ benchmarks. It’s common for concentrated portfolios (say, fewer than 40 holdings) to have around 25%-30% in their top-five holdings.

In theory, the practice of allocating relatively larger amounts of capital into a team’s best ideas makes sense, assuming it’s a skilled team. But in reality, the psychological biases of team members often result in unnecessary risks, such as heightened “idiosyncratic risk”. Also referred to as unsystematic risk, idiosyncratic risk is endemic to a particular asset such as a stock and not a whole investment portfolio.1 As a manager increases the active weight of any particular position, this introduces more room for excess performance, but it also increases idiosyncratic risk and diminishes the benefits of diversification.

Consider this hypothetical, yet realistic, scenario. An investment team spent months researching large cap stocks and decided that given the underperformance of Kraft Heinz stock, it represented a strong value and possessed superior risk/reward characteristics relative to other stocks in the team’s investable universe. The portfolio manager then initiated a small position in Kraft Heinz and continued adding to the position until it achieved his/her target weighting of 4% of the portfolio - a large position that justified the team’s strong conviction in the stock. This is relative to just a 0.13% weighting (as of 12/31/18) in the fund’s benchmark, the S&P 500 Index, which weights its holding according to market capitalization.

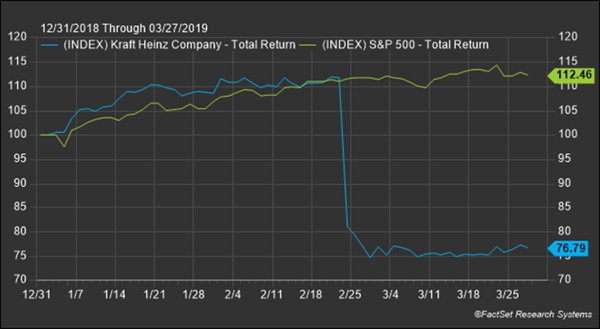

Then, on February 21st of this year, the company made headlines when it announced a $15.4 billion write-down due to weakness in some of its most-famous brands, in addition to an SEC investigation into the company’s accounting practices. The stock fell approximately 27% during the day’s trading session.

The Kraft Heinz Company (KHC) versus S&P 500 Index

12/31/2018 - 3/27/2019

While every active manager will occasionally own stocks that go on to underperform, there are steps that can be taken to mitigate these losses.

At Dana, we stray from the herd by equal-weighting our position sizes, which can help minimize drawdowns. It’s an area of our process we receive quite a few questions on, since it is so different from most managers. But we believe that trimming our winners and adding to our losers systematically helps us buy low and sell high, while forcing ourselves to avoid biases like anchoring and overconfidence. Through this philosophy, our investors can be assured that when drawdowns inevitably occur, there should not be any outsized idiosyncratic risks.

We are often underweight the largest holdings in large cap indices like the S&P 500 Index. Currently, the largest names in the S&P 500 Index are between 3% - 4% of the Index, and our Large Cap Equity Fund positions are around 2% each. But in small cap stocks, we tend to be overweight even the largest holdings since there are so many stocks in an index like the Russell 2000 Index, and even the largest holdings make up only 0.40% or less of the Index.2

1,2https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

The links above open new windows that are not part of www.danafunds.com.

Diversification does not ensure a profit or guarantee against loss.

Dana Large Cap Equity Fund top-ten holdings as of December 31, 2018: Pfizer Inc. (2.07%), Microsoft Corporation (2.06%), Amgen Inc. (2.05%), T-Mobile Inc. (2.03%), Alphabet Inc. Class A (2.03%), Kimberly-Clark Corp (2.02%), UnitedHealth Group Inc. (2.01%), Apple Inc. (2.01%), Comcast Corp (A) (2.00%), Intel Corp (1.99%).

Dana Small Cap Equity Fund top-ten holdings as of December 31, 2018: Chesapeake Utilities Corp. (2.00%), Marriott Vacations Worldwide Corporation (1.96%), Southwest Gas Corp (1.96%), Primerica Inc. (1.92%), Cadence Bancorporation Class A (1.84%), Western Alliance Bancorporation (1.80%), STAG Industrial Inc. (1.80%), First Bancorp (1.79%), Ruth's Hospitality Group Inc. (1.79%), Preferred Apartment Communities (1.78%).