2 Wrong Ways to Invest in ESG and SRI

As demand for environmental, social and governance (ESG) and socially responsible investing (SRI) investment products grows, advisors are tasked with sorting out the good options from the bad. Unfortunately, there are many problematic products, many of which have been “greenwashed” or marketed in a way that makes the fund appear more ethical or responsible than it really is, which could result in tough conversations with clients.

Here are two approaches you should be careful with:

1. ESG/SRI Overlays

This is one of the most common approaches, in which a portfolio manager takes an ordinary strategy/fund and then uses an overlay to screen out stocks or bonds that do not meet ESG/SRI criteria. This is also known as negative or exclusionary screening. The idea here is to exclude unethical companies in favor of “clean” or socially-responsible companies. Popular screens involve the exclusion of alcohol, tobacco, gambling or weapon companies.

The problem with negative screening is it does not prioritize or seek out best-in-class SRI/ESG companies, rather, it just eliminates those that are flagged or rank poorly.

For example, a portfolio manager using an overlay may not invest in a cigarette producer, but that capital probably won’t find its way to an SRI leader either.

Positive, or best-in-class, screening is an approach in which an investment team seeks out companies with positive ESG or SRI attributes. This usually requires a dedicated strategy, rather than just an overlay, and ideally permeates the entire culture of the firm. This way, everyone from the portfolio manager, to the analysts, to the sales and back-office staff is on board with the philosophy.

2. Indexing

There are many passively-managed ESG/SRI products in existence, where an investment team mimics the holdings of a given index. The problem here is the indexes are comprised of companies ranked on metrics provided by specialist rating firms, and the ESG factors are very subjective.

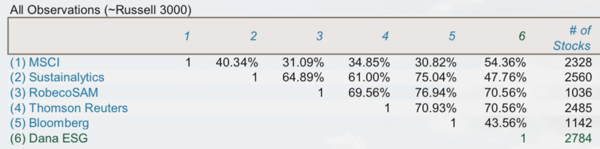

Looking at the data, it is difficult for investors and asset managers to find any high-level of correlation between vendor ESG scores. In an exercise we conducted last year (ESG Ratings – Differences Between ESG Scores Among Data Vendors)1, we computed the correlations between several vendors over an overlapping universe of U.S. stocks.

ESG Vendor Correlations (as of 9/30/18)

Sources: Dana Investment Advisors, MSCI, Sustainalytics, Thomson Reuters, Bloomberg, ISS, FactSet

Sources: Dana Investment Advisors, MSCI, Sustainalytics, Thomson Reuters, Bloomberg, ISS, FactSet

So, what kinds of stocks do these funds own, if the ratings vary so significantly? Many flagship ESG equity ETFs, such as those offered by ETF leader iShares, hold over 300 stocks. iShares uses various metrics from MSCI in their marketing material, such as “ESG Quality Score” and “Weighted Average Carbon Intensity,” but with 300 positions, explaining to a client what he or she owns could make for a difficult conversation.

The ESG and SRI space is constantly evolving, and as more capital pours in, investors are demanding more transparency and more thoughtful philosophies and investment processes. For now, finding an active manager with a history of thought leadership and a successful ESG track record is probably a good bet.

If you would like to be notified when we release new market insights, please fill out the form on the right, "Stay up to date with current market trends," and we will send you an email.

1 http://www.danainvestment.com/wp-content/uploads/2018/10/Dana-ESG-Ratings-October-2018-1.pdf

The links above open new windows that are not part of www.danafunds.com.

Dana Large Cap Equity Fund top-ten holdings as of June 30, 2019: Apple, Inc. (2.24%), Microsoft Corp. (2.21%), Alphabet, Inc. Class A (2.13%), Facebook, Inc. (2.12%), Stryker Corp. (2.10%), CDW Corp. (2.09%), Thermo Fischer Scientific, Inc. (2.07%), Zebra Technologies Corp. (2.04%), Broadcom, Inc. (2.03%), Comcast Corp. (A) (2.02%).

Dana Small Cap Equity Fund top-ten holdings as of June 30, 2019: Boot Barn Holdings, Inc. (2.03%), Rudolph Technologies, Inc. (2.02%), Southwest Gas Corp. (2.01%), Outfront Media, Inc. (2.01%), EastGroup Properties, Inc. (1.99%), CoreSite Realty Corp. (1.98%), ANI Pharmaceuticals, Inc. (1.91%), Chesapeake Utilities Corp. (1.91%), Rapid7, Inc. (1.91%), Stag Industrial, Inc. (1.90%).

Dana Epiphany ESG Equity Fund top-ten holdings as of June 30, 2019: Amazon.com (3.54%), Microsoft Corp. (3.13%), Apple, Inc. (3.08%), Visa, Inc. (3.04%), American Express Co. (2.89%), Nexterra Energy, Inc. (2.87%), Intel Corp. (2.80%), Automatic Data Processing (2.58%), PepsiCo, Inc. (2.55%), Mastercard, Inc. Class A (2.47%).