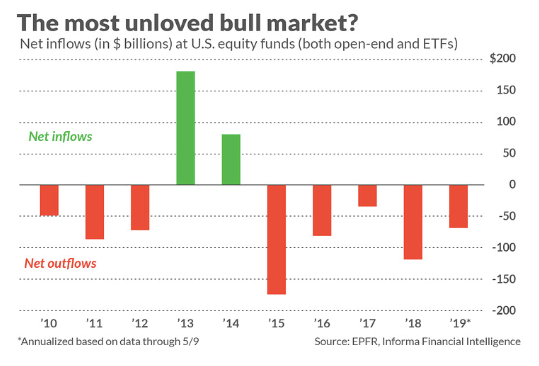

[Chart of the Month] Net Outflows and the Unloved Bull Market

When people think of economic recoveries and the bull markets that tend to follow, it’s easy to understand why it takes a while for many investors to get off the sidelines. After all, the stock market (S&P 500 Index) was down nearly 40% in 2008, so it’s not surprising that retail investors - still reeling from such a shocking selloff - were hesitant to jump back into equities.

But at some point, one would think retail investors would be ready to rejoin the party, right? Interestingly, the only period during this economic cycle where this has occurred was 2013-2014. Observe the graph below, which includes money flows into both mutual funds and ETFs:

Image source: https://www.marketwatch.com/story/heres-what-mutual-fund-investors-really-tell-us-about-the-stock-market-now-2019-05-29

Over the past decade, investors have pulled more than $400 billion out of the domestic equity markets.1 The short-lived spike in inflows during 2013-2014 makes sense, since this followed a 16% return in 2012, and the market rallied 32% and 14% in 2013 and 2014, respectively. From a supply and demand standpoint, it’s rather impressive that the market continued to make such strong gains throughout the latter half of the decade despite such an outflow of capital.

The first quarter of 2019 is a great example. “For the quarter, the S&P 500 Index rose 14%, even as U.S. equity funds posted outflows of $39.1 billion, according to a Bank of America analysis of EPFR data.”2 One obvious explanation for this is corporate buybacks. During the first quarter, S&P 500 companies repurchased $227 billion of their own stock, according to FactSet data, up from $143 billion in the first quarter of 2018. Open interest in options on stocks and indexes is another reason, having risen from a low of $-1.2 trillion in December to approximately $400 billion by the end of the first quarter. 3

In any case, if this trend reverses and retail money flows back into equity funds, it could prolong the late-cycle rally that has taken place over the past few years.