ESG Investing: The Tenor of Management Teams is Changing

During a career that has spanned more than 20 years at Dana Investments, portfolio manager Duane Roberts has seen management teams’ attitudes toward ESG (Environmental, Social, Governance) issues change considerably. In a brief interview, he reflected on how the tenor of management teams has changed, particularly in recent years. Excerpts from that interview follow:

Q: Dana was looking at ESG issues 20 years ago. What were conversations with management teams like then compared to today?

Duane Roberts: Twenty years ago, there wasn’t a lot of engagement from management. If you had a question, it was usually fielded by someone on the investor relations (IR) team, and maybe they would trickle it up to an attorney if it was about lobbying or political spending, or to someone in operations if it was an operational issue.

Then, about five to 10 years ago, depending on the company, you saw more firms hire chief sustainability officers, or other titles, where the specific role was to consider sustainability issues. This was in response to companies having to answer more and more questions from investors, and also from rating agencies that evaluate ESG issues. That specialization started with large, multinational firms, but has filtered down to companies with smaller market capitalizations.

In just the past two years, we’re seeing some really big changes, with a lot more direct conversations with management coming up in earnings calls or meetings. You’re seeing CEOs talking about ESG, or speaking at ESG conferences.

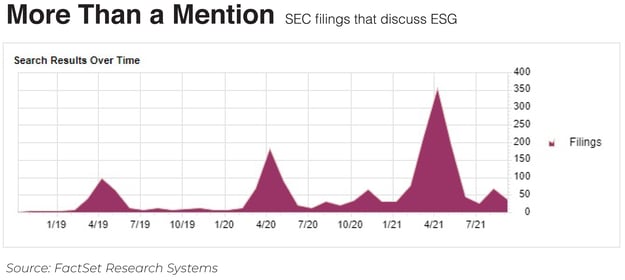

The chart above shows the mentions of ESG in SEC filings. The spikes represent periods around annual filings, but a trend is emerging: ESG is becoming a much more common topic at corporations.

Q: What percentage of executives seem engaged and well-informed on ESG issues?

Duane Roberts: Just a few years ago, when you would hear a CEO respond to a question, there was often skepticism, or vagueness in their answers. Today you’re seeing more and more CEOs respond in a way that instills some confidence they understand the issues at a deeper level.

I would say just a few years ago, the percentage of CEOs who could talk deep in the weeds about an ESG issue was probably in the high single digits. Today, I’d say the majority of CEOs seem informed.

Q: What is a sector or industry where you’ve seen management communication improve most?

Duane Roberts: CEOs of several finance companies have really become ESG leaders. They’re still capitalists, they’re still managing to maximize profits, but they see the issues and are willing to move the company in directions that will support climate issues or affordable housing, for example. With some banks, we’re seeing them become a lot more selective in financing fossil-related activities.

Some have also done a lot to promote diversity as well.

Q: Are there other sectors where you see big changes?

Duane Roberts: Technology firms have been pushed a lot on supply chain issues. Compared to other industries, they were already ahead of the curve in talking about ESG issues. But more recently they were really pushed about their supply chains and were encouraged to promote more women – both in software-related jobs and at the board level. They’ve made strides in addressing those areas of concern. More progress needs to be made, and there are other issues that need to be addressed, such as consumer privacy.

Q: Which areas do management teams need to do a better job of addressing in the next few years?

Duane Roberts: Among energy companies, there’s a wide dispersion in how well they address ESG issues – not just around reduction and capture of carbon emissions, but in whether the firm’s strategic business plans seem to recognize we are in an energy transition. There’s wide dispersion – some management teams are thoughtful – but we’d like to see more from others.

Among retail companies, and specifically clothing companies, some need to play catchup in addressing labor risk within their supply chains. However, there are a few clothing companies taking leadership on these issues.