Explaining the Differences Between ESG Scores Among Data Vendors

Since the wave of new ESG (environmental, social and governance) specific and larger well-known data vendors rolled onto the ESG data scene, it has become more difficult for investors and asset managers to find any high-level of correlation between vendor ESG scores. In this blog we discuss some of the possible reasons for the differences in scores across companies and how users of these ratings might navigate these challenges to drive mission alignment, risk mitigation and alpha generation.

Image Source: NGCSoftware.com

Data covering ESG factors has become important not only to investors seeking a “responsible investment” approach, but also to a much broader investment audience. This wider audience sees the opportunity for ESG data to enhance security selection, as it shows potential for both risk reduction and alpha generation. Unfortunately, ratings between data vendors vary considerably.

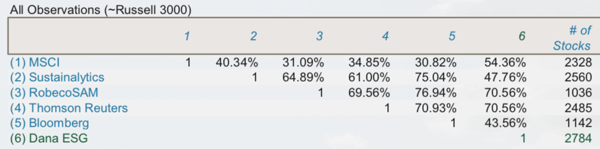

One way to gain insight into this dilemma is to examine the correlations over a universe of companies between any two vendors. In the example below, we computed the correlations between several vendors over an overlapping universe of U.S. stocks. For the firms with the broadest U.S. coverage (Sustainalytics and MSCI), the universe is approximately the Russell 3000 Index members. In addition to the vendor correlations, we show the number of stocks for which we have ratings from each vendor.

ESG Vendor Correlations (as of 9/30/18)

Sources: Dana Investment Advisors, MSCI, Sustainalytics, Thomson Reuters, Bloomberg, ISS, FactSet

Surprised these correlations are not higher? Wondering why is there not more agreement in the results?

We suggest three influences that reduce the correlations.

- First, ESG remains inherently subjective. While all vendors are incorporating environmental, social and governance factors in their assessments, the specific data points and relative importance of various data vary from vendor to vendor (individual investors might vary even more).

- Second, while some ESG information is company-reported and should therefore be consistent from vendor to vendor, other data may result from vendor or third-party research that yields different values even when attempting to measure the same thing.

- Third, each vendor has developed a unique methodology to produce rankings. All of these approaches have distinctive strengths, but as they often measure contrasting aspects of ESG performance and process data in varying ways, differences in the rankings are inevitable.

This content is an excerpt from an in-depth whitepaper on ESG ratings. To read the full document, click below.