Finding Relative Value in a Ruckus Investing World

September lived up to its notoriously risky bill. Stocks got rocked, bonds were crushed, and major parts of the forex markets traded with the volatility normally seen in emerging market currencies. At Dana, we see this dip across equity markets as an opportunity for long-term investors. Higher bond market yields also offer the chance to own the right fixed-income securities at bargain prices. A case can be made, in fact, that now is one of the better times to be putting money to work in a properly allocated portfolio than at any other time in the last decade-plus.

Parts of the U.S. stock market sell for low price-to-earnings (P/E)i multiples while profit margins remain high and free cash flow holds up for certain companies. We’re not saying investors who have a few extra bucks take a trip to the stock market candy store since there are still pricey areas. Also, higher yields on fixed-income securities have put the kybosh on the “TINA” (there is no alternative) trade, but we’ll explain why we think that’s a flawed valuation outlook.

While the consumer feels tapped out and investor confidence is abysmal, portfolio managers at Dana are chomping at the bit to dig and find relative value in this turbulent investing world. While some stocks still trade at lofty valuations, there are so many more opportunities out there today.

Sifting for Value in the S&P 500

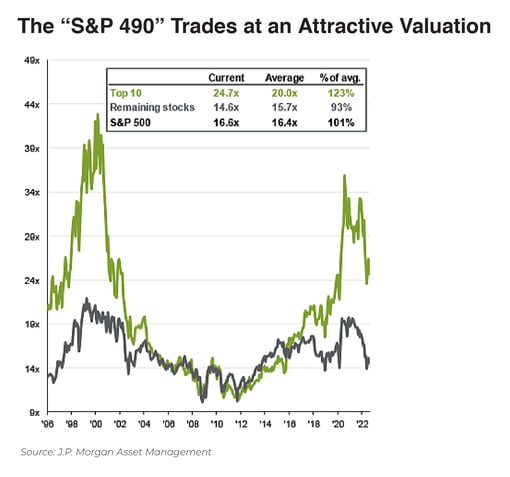

What a difference a year makes. In late 2021, the “trillion-dollar market cap club” was getting a lot of press. Its three major occupants were Apple, Microsoft, and Alphabet, and other less-profitable consumer companies were busting in. It seemed the biggest of big domestic corporations could do no wrong, and their forward P/E ratios reflected that. Earnings multiples soared above 25 for those somewhat boring market leaders. A decade ago, that aforementioned trio of stocks traded at a fraction of their valuation seen just 12 months ago.ii Even today, they sport multiples significantly above the market’s average. Some pundits claim those ratios must retreat before the market can bottom.

We won’t play that guessing game on when and where the S&P 500 hits a true low, but we like scooping up areas of relative value outside of the mega-caps in our Large Cap Equity Strategy. Outside of the top 10 biggest SPX, equities don’t look so bad. Consider that the group now sells for a valuation below its long-term average while the top 10 continues to garner a historically high forward earnings multiple. We prefer to put the work into finding true value away from the glitz and glamour of the very biggest names.

Uncovering Gems in Small- and Mid-Cap Stocks

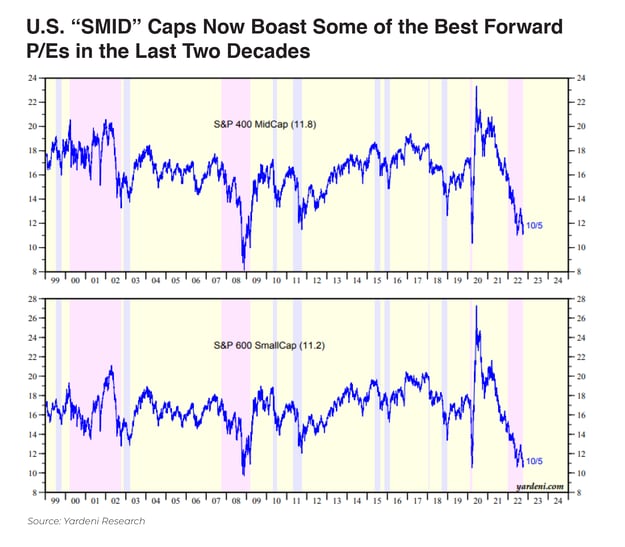

It’s not just within the large-cap space where Dana finds relative value. There are chances to own solid up-and-coming companies in the “SMID” cap space, too. One method of doing so is to look for profitable companies with strong free cash flow. Referring back to 2021, it was all the rage to own untested new firms like IPO stocks and SPACs, but those have been a downright disaster in 2022. Relative value among smaller stocks requires identifying companies whose attractive growth prospects are undervalued relative to their peers.

Within the SMID cap spectrum, you’ll find some of the best valuations since the 1990s, sans the Great Financial Crisis. Our Small Cap Equity portfolio uses a process-driven approach using both quantitative modeling and fundamental research to find relative value. The small cap world often features enhanced volatility and more downside compared to large caps during bear markets. Dana’s security selection method includes specific risk controls to help avoid potential value traps.

Is the Stock or Bond Market Wrong?

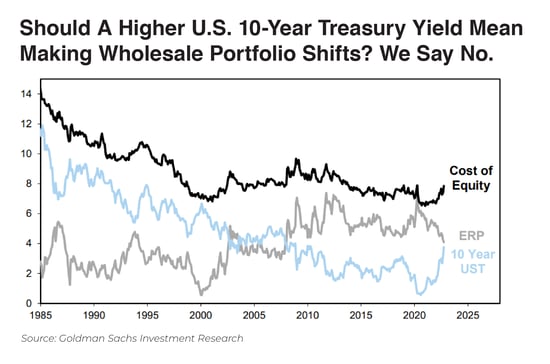

The question of relative value is not confined to choosing the right companies to own in an equity portfolio. As bond yields have risen dramatically in 2022, many investors and advisors might consider layering on more fixed-income exposure for the years ahead. Some strategists point to a much lower equity risk premium on the S&P 500. Are they right? Should we take money that had been set aside for shares and buy some paper?

We recognize that balance can be a good thing, but it’s also important to be mindful of long-term returns net of inflation. According to data from Robert Shiller at Yale, the U.S. stock market has historically returned about 7% per year (including dividends, after inflation).iii Bonds, as measured by total returns on the U.S. 10-year Treasury, usually beat inflation by less than 2% annually.iv We don’t see any reason those norms should dramatically change now. We assert, over the long haul, there is relative value in stocks today.

Of course, we are not saying to bail out of bonds. Quite the contrary — there’s tremendous alphav to be made in beaten-down parts of the credit markets. Our fixed income managers are more excited today than we’ve seen them in so many years. At a macro level, we expect that market conditions should normalize, and the 10-year Treasury rate should retreat.

Assessing the Playing Field, Weighing the Evidence

Investors and advisors can read some spooky stories this time of year. With the stock market pacing for one of its worst annual performances since the Great Depression and the aggregate U.S. bond market about to notch its worst year since performance numbers were first tracked (1977), buying (or selling) into depressing narratives can be easy.vi

That’s not how we see things. Such volatility along with lower prices across the equity and fixed-income markets creates an environment conducive to researching and owning strong relative value companies at good prices. Dana’s research method, time-tested over several market cycles, is appropriate for such a time as this.

Check out Dana’s Equity Strategies which employ risk controls and processes to identify companies whose attractive growth prospects are undervalued relative to their peers. By buying attractively ranked stocks, we seek to add value over time. The time is right to own the right stocks at good prices using a relative value methodology.