Is Now the Time to Invest in Small Caps?

Small caps fell more than 20% in 2022. It was the 10th worst annual return for the space in its history, according to data gathered by research firm Jefferies. That drop, which brought the Russell 2000 index not far from the same levels at which it traded more than four years ago in August 2018, makes for many interesting long opportunities this year and in the decade ahead. Moreover, with a recent pickup in merger and acquisition (M&A) activity in the speculative biotech industry or software, there’s the case to be made that we are turning the corner on defensive positioning, which was a hallmark of 2022.i

Also, history shows that after substantial yearly declines, like the one we just endured, small caps tend to snap back with a median return near 20%, according to research from Jefferies. Will it be different this time? What are the risks and opportunities? Let’s dig into the small-cap niche of the stock market.

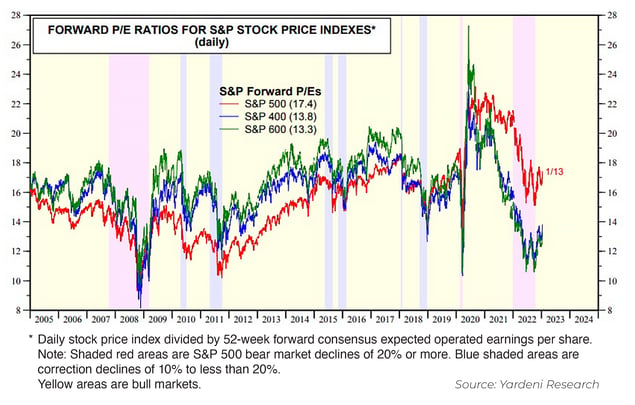

Low Valuations

It’s no secret that valuations on major small-cap indices such as the Russell 2000 and the S&P SmallCap 600 are, on the surface, much more attractive relative to their large-cap peers. At latest check, the SmallCap 600 trades at just 13.3 times forecasted 2023 earnings compared to the S&P 500’s (SPX) loftier 17.4 forward earnings multiple. As for the broader Russell 2000, it too trades at a 13.3 year-ahead price-to-earnings (P/E) ratio.*

Critics (and the bears) like to point out that the Russell 2000’s earnings ratio backs out firms that do not earn profits — toss back in the non-earners, and the Russell 2000’s forward P/E jumps to near 22. Additionally, the SmallCap 600 index includes only profitable firms, so its P/E ratio is thought to be distorted.

Small-Cap Valuations: Near Historic Lows

Does that mean the group is not as cheap and that future returns will be lousy? Not so fast. Data from Bank of America Global Research took aim at that critique from the small-cap bears. It turns out that the P/E including only the positive-earning firms is more predictive of future returns than the all-encompassing P/E (an R-squared of 45% versus just 31% for the P/E including non-earners and outliers). So, while there’s never a slam dunk in the asset allocation business, investors should feel better about what returns could be in store over the coming decade for small caps.

Diversification**

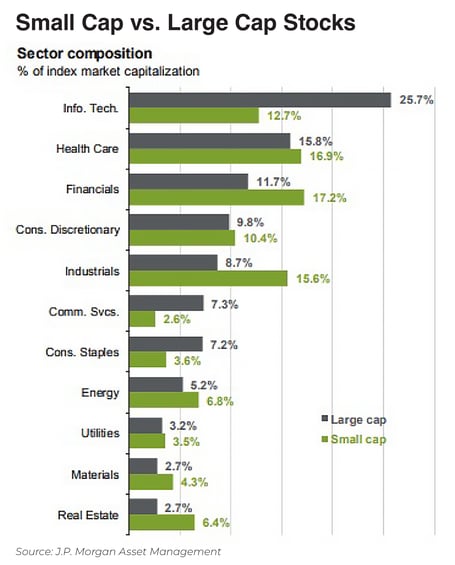

Another aspect about small-cap equities that make them attractive right now, and something that likely led to their relative rebound during the latter months of 2022, was that the group is less concentrated and more spread out across sectors compared to the S&P 500’s makeup.

Consider that near the end of 2021, shortly before the lone all-time high of 2022 was notched in the S&P 500, the top 10 stocks in the index were nearly 32% of the SPX. Contrast that recent high-concentration figure with under 19% exposed to the top 10 back in 2015. Even during the dot-com bubble of 1999-2000, the max concentration level was just 27%, according to J.P. Morgan Asset Management. And what were those mega-cap equities in the top 10 at end of 2021? Eight were from the so-called tech-media-telecom (TMT) industries or within the growth-heavy consumer discretionary sector.

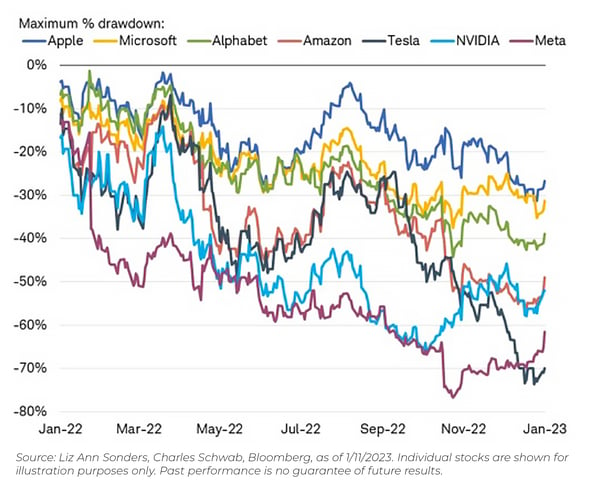

Now let’s hop over to small-cap land. While heavy concentration helped large-cap U.S. stock indexes outperform for much of the time from the late 2000s through 2021, that composition finally came home to roost last year with the Nasdaq plunging by about one-third and the SPX losing almost 20%. To be clear, 2022 was no picnic, or even a year of outperformance, for the Russell 2000. But some signs of hope for small-cap investors were seen in the second half of last year as both the Russell 2000 and S&P SmallCap 600 indices modestly beat large caps. Among the culprits for King S&P 500 perhaps finally being dethroned were beatings endured among its top holdings — the notorious and once-loved FAAMG (former acronym for Facebook, Apple, Amazon, Microsoft, Google) stocks. The bears came after the generals of the market.

“Super 7” Mega Cap Drawdowns

As it stands today, the Russell 2000 has more diversification than the S&P 500. The largest sector weights are financials, health care, and industrials at about 16% each, according to Russell. High-growth areas like information technology and consumer discretionary make up just under one-quarter of the index while the commodity-sensitive and value-tilted energy and materials sectors together account for about 11%. Contrast that with the S&P 500’s 26% allocation to information technology and paltry 8% combined position in energy and materials.

Sector Neutral in Small Caps Means Owning More Value, Less Growth Versus Large Caps

Dana is not an index fund investor. But the above analysis of what all is in the large-cap and small-cap indexes helps illustrate that there may be more opportunities away from the biggest U.S. equities today. After a sixth consecutive year of Russell 2000 underperformance versus the Russell 1000, now could be an opportune time to put money to work in out-of-favor small companies carefully chosen from a risk and reward point of view by our experienced team of portfolio managers.

A New Regime?

Amid such an enduring period of large-sized stocks beating small caps, Jefferies notes that the relative valuation percentile between the two sizes reached a contrarian 14 level by the end of last year. That comes as small-cap earnings appear to be hanging in there better than large-caps along with the noted pick up in M&A activity.

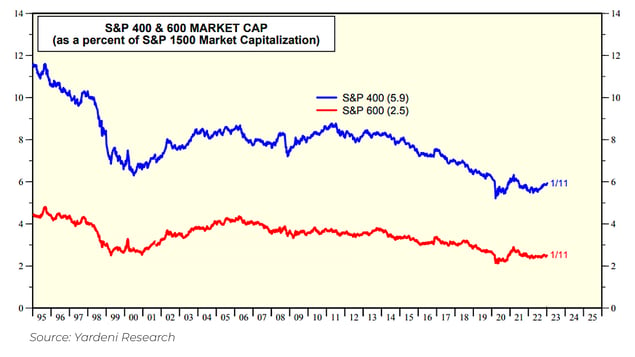

What’s more, a new disinflationary regime could actually be a boon for the small-size factor. It turns out that when inflation is above 3%, but on the decline, small caps tend to do best, according to Jefferies. At just 4% of the total U.S. stock market — near historical lows — the recent relative bear market in the size factor could set the stage for a mean-reversion theme in the years ahead. The last time “the smalls” were this, well...small, was for a moment during 2020 and way back in the 1930s.

The SmallCap 600 Index’s Weight as a Percent of the Total U.S. Market Is Historically Low

Many macro strategists suggest the next decade could look much different than the 2010s when assessing the broad economic and investing backdrops. For instance, more re-shoring of manufacturing and material-sourcing activities could take place while inflation runs higher than the below-2% average seen during much of the prior cycle.

We are also perhaps in a new monetary reality of quantitative tightening rather than accommodative quantitative easing, which might be a headwind for growth equities, as financial engineering via stock buybacks could be less prevalent among the biggest domestic companies. A key risk that our portfolio managers are on the lookout for, though, is how some individual small firms refinance their debt amid today’s higher interest rates.

Lastly, if we are in a world of slightly higher inflation and interest rates, that might favor small caps writ large over mega caps due to index composition differences described earlier. And these investment trends tend to feature extended runs, not just small jolts of temporary outperformance.

Could this new (but more historically normal) investment regime play out? It seems plausible, but our team remains open to all ideas and remains steadfast in our repeatable process of security selection of both growth and value stocks based on quantitative modeling and fundamental research. Dana’s Epiphany ESG Small Cap Equity Fund takes a diversified approach by owning approximately 60 to 65 U.S. small-cap stocks. We employ risk controls throughout the portfolio construction process. The aim is to add value through a disciplined fundamental stock selection methodology.

The Bottom Line

After a bruising year across the stock and bond markets, and with both large and small equities getting hit hard, we see opportunities in small caps following its yearslong underperformance. Volatility is likely to persist over the coming months (and maybe longer), Dana’s team of equity analysts and portfolio managers continues to find companies with solid businesses at reasonable valuations.

Learn more about the Dana Epiphany ESG Small Cap Equity Fund. Our team is built on the belief that adhering to a defined investment process allows our professionals to focus on the fundamentals of consistent outperformance through security selection. Our sector-neutral approach avoids large macro bets and active sector calls so that we can focus on finding the best individual stocks. With that strategy, investors can benefit by owning small caps should mean reversion across broad themes unfold.