Playing to Our Strengths in a Fed-Dominated Fixed-Income World

We closed out 2022 with one of the biggest and best sporting events worldwide — the World Cup. While the game of soccer sometimes catches some flak for its lack of scoring and hard-hitting plays that we are accustomed to seeing in American football, the game of soccer is known throughout the world as “the beautiful game”. Yes, most of the typical game is spent with the ball being passed around the middle of the field, but it is those special few minutes when the action is confined near the goals where the magic happens. The last 18 yards on either side of the field or the “tails”, if you will, are the high impact areas that generally determine the outcome of the games. This analogy is similar to how investment managers create outperformance or alpha for their investment strategies.i Think of the middle of field as the “market consensus” or average expectations as a lot of time and investment discussions are spent in the middle of the field among the majority of market participants. If you want market returns then play it safe and spend all your time passing the ball around in the middle of the field but if you want to outperform the market then you have to do something different than the market consensus. You must spend some time in the goal areas or the tails if you want to outperform the market. At Dana, we are not in the business of trying to predict macro events — stock market moves or interest rate forecasts. We construct portfolios based on assessing risks and opportunities. When opportunities arise, we send the ball into the goal areas with the expectation to capitalize on the opportunity in order to generate outperformance for our investment strategies. As we look at the bond market today, we have the excitement of playing in a World Cup match and see tremendous opportunities regardless of the next interest rate decision.

Gone are the days of Alan Greenspan’s Fed being somewhat hush-hush and opaque about policy. Can anyone forget his famously tongue-in-cheek quip, “If I seem unduly clear to you, you must have misunderstood what I said.” Today, nearly every day outside of Fed blackout periods, some Federal Reserve governor or regional Fed president is talking hawkishly about keeping rates ‘higher for longer’ or waiting for definitive signs that inflation is on the mend returning to the Fed’s target of 2% to 2.5%. The constant chatter is compounded by the financial media and broad macro strategists endlessly debating the issue. It may fill airtime on financial networks as the media needs a spin for daily market swings but it’s overwhelming and exhausting for what purpose?

As portfolio managers, we spend our time separating the noise from the signal to anticipate what is going to matter going forward as we begin our run to the goal areas. At Dana, within the fixed income market, we see attractive yields that have not been present for much of the last 15 years. We stay committed to our fundamental investment process by positioning portfolios based not only on understanding current market conditions but, more importantly, where the market is going. The financial markets are discounting machines as they anticipate future actions into today’s present value, and investors will miss taking a shot on goal if they wait for the Federal Open Market Committee (FOMC) to pivot or continue to spend time debating financial information that is already priced into the markets. To help separate the noise from the signal, it is important to recognize as well as clarify the roles of three different groups on the soccer field — the officials “the Federal Reserve”, the announcers “the media”, and the players “investment managers” such as Dana.

The Fed’s Job

The Fed has a dual mandate to maximize employment and keep inflation in check through stable prices and moderate long-term interest rates. Monetary policy actions such as raising or lowering the short-term interest rate known as the Federal Funds rate as well as adjusting the money supply are the primary tools the Fed uses to achieve their mandate. The Fed communicates their actions to the financial markets through “forward guidance” which informs the financial markets about expectations as well as effects of future monetary policy actions on financial conditions in order to achieve the dual mandate. Ultimately, forward guidance centers on controlling expectations and pricing volatility. If the Fed issues a hawkish statement on their expectations for the future path of the Federal Funds rate in order to promote price stability then, the bond market will immediately adjust interest rates higher as they anticipate a higher discount rate into security pricing. The challenge with controlling expectation and pricing volatility is Fed Chairman Powell and the other members must constantly appear in interviews, issue statements, and give speeches that are in alignment with where they want policy to be going forward. It’s quite the pageantry.

The Media’s Job

The Media’s role is quite simply to fill the stadium seats so we’ll keep this section quite brief. The recipe for filling the seats — provide insight or elicit an emotion. The financial media offers a great outlet for insightful guests and commentary; however, the media can spend way too much airtime debating issues just to fill a time slot. Case in point, what will the Fed do next? Endless hours and days spent on speculating on whether a 25-basis-point hike is in the cards at the next FOMC meeting or if a larger half-point increase is in the works? After the umpteenth time and the umpteenth day, you have to ask yourself does it matter? We do not see investment alpha coming from that back and forth.

Dana’s Job

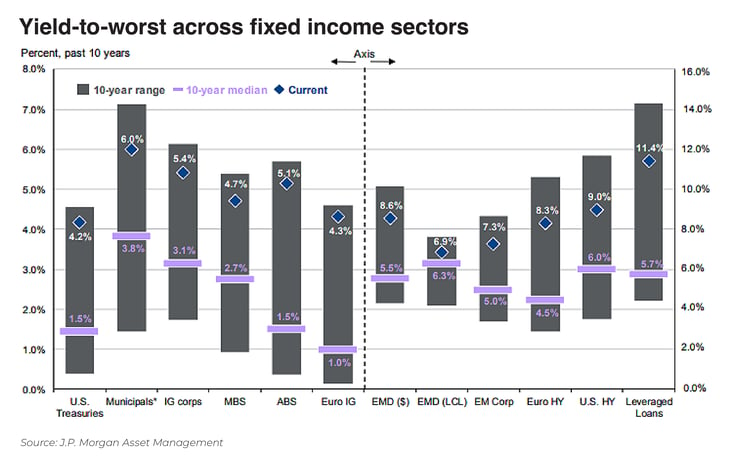

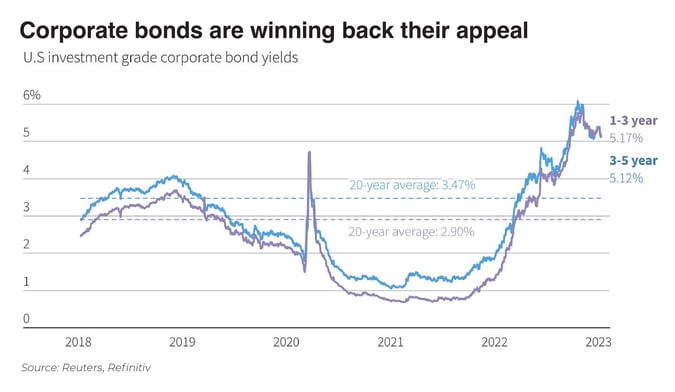

Let’s start where we left off on debating Fed moves. If everyone knows that the Fed is going to move then ask yourself “where is your edge or competitive advantage?” You have none as the participants within the financial markets have already incorporated the information into security prices. Does Dana have a viewpoint on future Fed actions? Absolutely and, to outperform the market, we need to get ourselves into the goal area by breaking away from the market consensus. How do we do that? We have to act on opportunities that the market consensus has not yet incorporated into the prices of securities. After a lift of over 400 basis points in the Federal Funds rate in 2022 and more on the horizon for 2023, we are upbeat about the opportunities available in today’s fixed-income market. Consider that compared with 10-year historical ranges and averages illustrated below, yields across the bond space are offering compelling value. We have positioned portfolios to take advantage of elevated short-term rates that feature low duration. After 15 years of earning next to nothing on high-grade, short-maturity bonds, we can own such securities with yields near or even slightly above 5%. Additionally, our portfolio managers have been able to purchase individual bonds with unique characteristics that offer expected higher total holding period returns without taking on much additional interest rate or credit risk.

Current Yields Are Attractive Relative to History

Bonds are Back: Investment Grade, Low Duration Credit Yields > 5%

You Play to Win the Game

Calendar year 2022 certainly was a challenging period as the Federal Reserve spent the year re-normalizing the yield curve but, as we begin 2023, the fixed income opportunities give rise to optimism for investors. Bond market yields are back to attractive levels, the majority of monetary tightening is behind us, and inflation is likely to continue to soften. A portfolio of high-quality bonds consisting of U.S. Treasuries, U.S. Agencies, and investment-grade corporate bonds can yield close to 5% without high interest rate risk. Tax-exempt yields in municipal bonds are also attractive for investors in higher tax brackets. In these uncertain periods, investors need to maintain a well-diversified core fixed income portfolio in an active manner to continue compounding interest rates no matter what path interest rates may follow into the future. Whether the yield curve flattens, steepens, twists, or inverts investors need to maintain an allocation to fixed income. Fixed income investments provide important benefits, including income, diversification from equities, lower volatility and the predictability of an income stream. Granted, it is very uncomfortable and takes a disciplined mindset to break from the market consensus but if investors want to outperform then they need to play in the goal areas — where the magic happens.