The Holy Grail? Economic Growth, Low Unemployment and Low Inflation

What a difference 15 months makes. In the fourth quarter of 2018, the market was down almost 20% through Christmas Eve and had dropped over 10% in just the middle two weeks of December. Jerome Powell had just led the Federal Reserve to the fourth interest rate increase of 2018. Regardless of the market drop, Powell seemed to have a ‘what, me worry?’ attitude. He said that the balance sheet reduction was on autopilot.

Throughout 2018, we feared that the Fed was an unwitting enemy of both the markets and the economy, and that became clear at year-end. Powell tempered his tone, and the Fed embarked on what seemed like an interminably long pause until it cut rates at the end of July 2019. During that period, the ten-year Treasury yield fell below short-term rates in late May and remained there until early October. The equity markets traded in a range through the summer and fall, and only moved to new highs just before the last Fed cut in October. Since then, the move upward has continued with markets constantly nearing all-time highs. The Fed has since telegraphed an ‘on hold’ policy going forward.

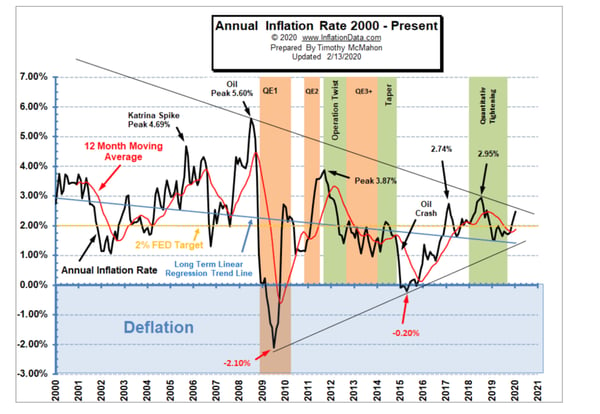

Our operating hypothesis through this tightening cycle was that the Fed was the problem, and now they have become the solution. This rate cycle has taught them that we can have growth, low unemployment, and low inflation simultaneously. This scenario would seem to be the economic holy grail, and now with the Fed on hold, we can see what that looks like. Powell’s new framework for rate policy moves inflation front and center; we believe this should always be the focus of the Fed. Powell has recently said that they might be willing to let inflation run above their 2% target for a period of time and that he sees no scenario where they would undertake a rate increase if inflation stays below 2%. Let’s hope he means it.

Below is a visualization displaying the annual inflation rate over the past 20 years:

Annual Inflation Rate

2000 – Present Source: https://inflationdata.com/articles/charts/annual-inflation-chart/

Source: https://inflationdata.com/articles/charts/annual-inflation-chart/

Market valuation and overall growth are two concerns going forward. S&P 500 Index earnings were close to flat in 2019, so valuation levels have increased as the market has delivered a significant gain in price. Economic growth has slowed to 2016 levels after a bump up from the tax cuts, and trade policy has been a drag on capital investment. Nevertheless, there are good signs as well. Commodity prices have stabilized after dipping earlier in February on Coronavirus concerns. Oil has moved back up to the mid-$50s level and is trending higher, which helps capital investment and bond spreads in the energy sector. Two areas we watch closely for signs of stress are credit spreads and the housing market, and both are performing as well as they have in recent years.